DGLegacy’s 2025 Report warns that digital fragmentation and lack of inheritance awareness could erase a historic portion of intergenerational wealth.

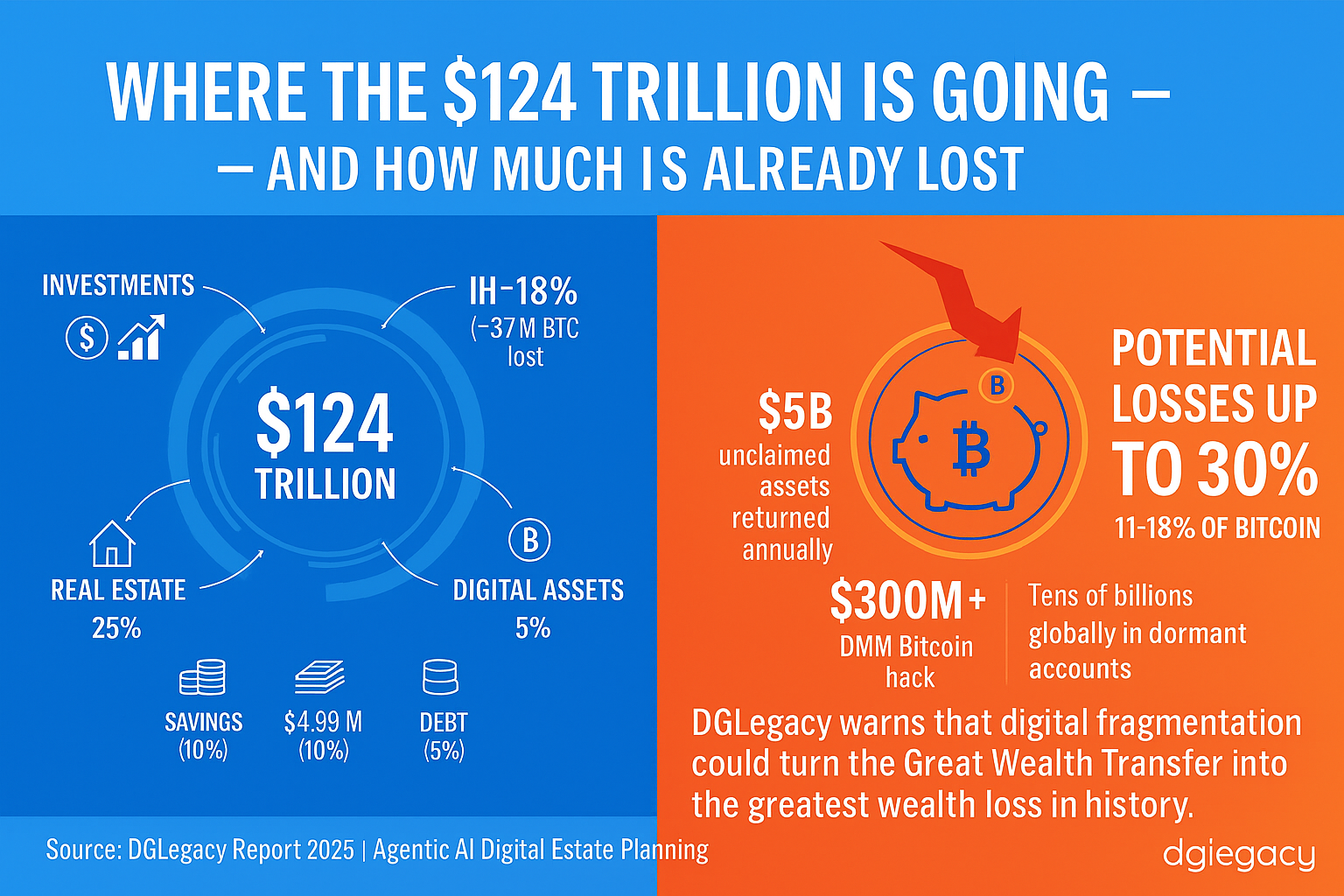

The largest intergenerational wealth transfer in history is underway. According to Cerulli Associates, an estimated $124 trillion in U.S. household wealth will change hands by 2048 — the largest in recorded history. Building on this projection, the DGLegacy® Report 2025 warns that digital fragmentation and lack of inheritance awareness could erase a historic portion of that wealth.

The alarming signs are already here

An estimated 11–18% of Bitcoin’s total supply — about 3.7 million BTC — is already lost, worth tens of billions of dollars. And crypto is just the beginning. In the United States, states return nearly $5 billion annually in unclaimed assets from forgotten brokerage accounts, dormant insurance policies, and abandoned pensions. Globally, tens of billions more sit idle in “lost” financial accounts that families don’t even know exist.

“The same demographic forces driving this historic wealth transfer are also creating the perfect storm for wealth loss,” says Ana Mineva, Co-Founder & CEO at DGLegacy®. “We’re seeing digital assets spread across countries, no unified succession plans, and a growing number of people without direct heirs.”

Why traditional Estate Planning is failing

Modern wealth moves faster than traditional inheritance tools can handle.

Crypto’s fatal flaw: Up to 3.7 million Bitcoin are likely lost forever. Even “secure” holdings can vanish before heirs see a cent, as shown in the $300M DMM Bitcoin hack.

The childless inheritance puzzle: One in six Americans over 55 and one in five German women in their late 40s have no children. For them, the question isn’t just “who inherits?” — it’s “will anyone even know these assets exist?”

Cross-border chaos: Today’s investors hold company shares in Delaware, bank accounts in Switzerland, real estate in Spain, and crypto wallets scattered globally. Without a unified plan, heirs are left searching blind.

Estate planning’s blind spot: Traditional estate plans rely on catch-all clauses that sound reassuring — “all remaining assets shall go to…” — but these clauses can’t solve the fundamental problem: your heirs don’t know what or where “all” is.

Without transparency and awareness, even the most meticulously drafted estate plan becomes useless. Your assets today look nothing like they did two years ago — you’ve added crypto wallets, online trading accounts, digital investment platforms, side hustles, stock options, and policies spread across multiple countries. Your estate plan is static, but your wealth is dynamic — and your heirs are left in the dark about what actually exists.

The result? Estate proceeds themselves now rank among the most commonly abandoned asset types, contributing to the $4.49 billion in unclaimed property that U.S. states returned in fiscal year 2024. Families can’t claim what they can’t find — and catch-all clauses can’t catch what heirs don’t know exists.

The emerging solution

Digital legacy planning platforms like DGLegacy® are stepping in to bridge the gap between modern wealth and outdated inheritance tools. These services provide:

-

A secure vault mapping all assets — from exchange accounts and crypto wallets to policy numbers and ownership deeds

-

Clear beneficiary designations for both financial and digital assets

-

Automatic detection of fatal events and proactive heir notifications

-

Cross-border guidance to navigate multiple legal and financial frameworks

“Without these systems, families are forced to guess, search, and often fail,” Mineva adds. “With them, wealth — no matter how digital or global — can actually transfer as intended. The tools exist. The question is whether people will adopt them before it’s too late.”

The verdict: $124 Trillion hangs in the balance

The Great Wealth Transfer is inevitable. But whether it becomes a historic preservation of family wealth or the greatest wealth loss in history depends on one thing — whether this generation closes the planning gap for digital assets now.

To learn more about protecting your digital inheritance, visit www.dglegacy.com.