Digital Inheritance

Nowadays, things have changed. Many people, even if not rich, have various assets such as life insurance, bank accounts, and a pension fund. People who work in startups and tech companies also have stock options or RSUs, and investment in company stocks is becoming a fashionable trend.

The problem is that many of these assets are digital and they change quite often. They are not static. Expats move from country to country and open new bank accounts; tech people move to new companies where they get RSUs and stock options in different asset vaults; people change their behavior, and one sunny day, a clerk of a company decides that he will be an investor and opens an account on an online trading platform.

Because of this dynamic behavior and the digital nature of assets, old fashioned inheritance and wills just don’t solve the problem. Imagine, for example, if you had to go to an attorney to create a new will or update your existing one each time your assets or list of beneficiaries changed. This would be an expensive and time-consuming process.

How, then, can people find an easy way to secure their assets and protect their families’ inheritance?

Let’s see several ways how this can be achieved.

Secure digital vaults

Digital vaults became popular in the late 2000s. They served a very specific purpose: people could securely store in them confidential and sensitive information and access this information from anywhere. Some vaults specialized in password storage, others were more focussed on storing and organizing documents such as health records, passport scans, and insurance policies.

The primary benefit of these secure digital vaults is that they can be accessed from anywhere, as they are online. But while they are great for storing confidential digital records, they fall short in fulfilling the goal of digital inheritance.

The primary requirement of a vault is to be very secure, so pivoting these systems to designate beneficiaries and provide them with access to the stored information is not a trivial task. Because of this, vaults simply can’t serve the purpose of digital inheritance tools. Their information is predominantly available to the owner of the asset.

In recent years, some vaults have tried to pivot and to provide some sort of digital inheritance features, but again, it’s not easy for systems designed not to share their information to start sharing it with people who are not the owners of the vault account – the beneficiaries.

How does DGLegacy provide digital inheritance?

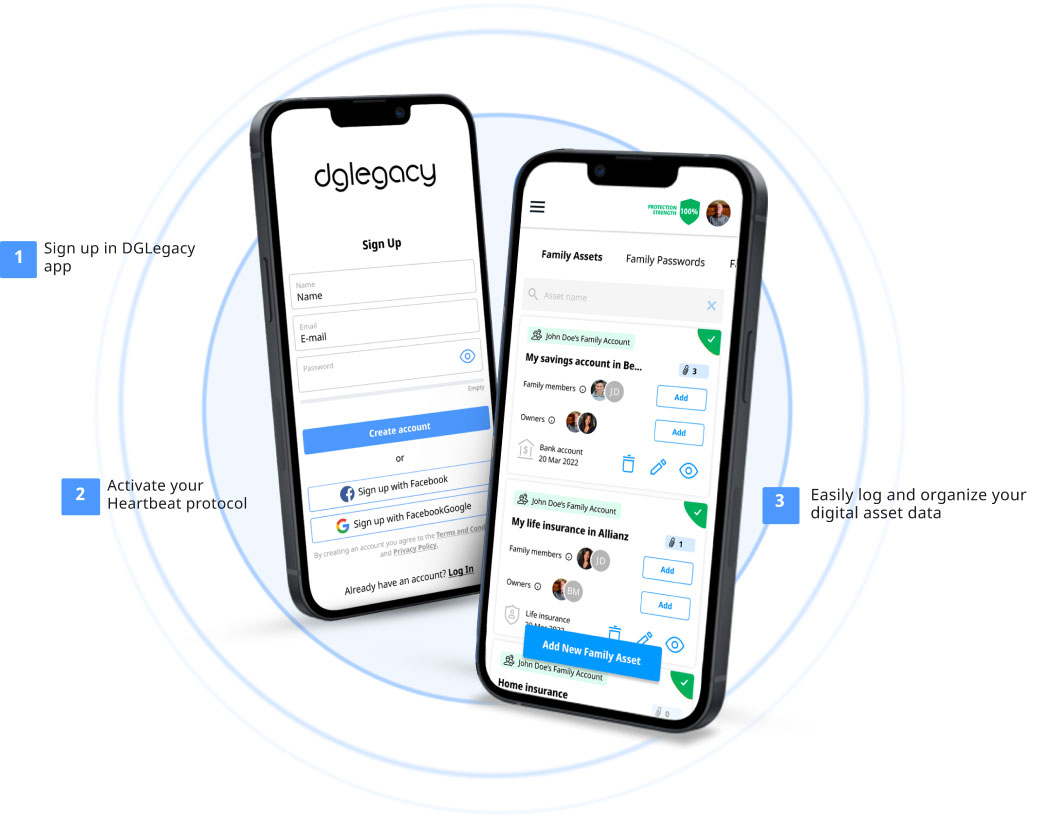

Second, the application has a custom-engineered Heartbeat protocol, which detects unforeseen events happening to the user. Upon detection of such an event, the information about the assets is provided to the beneficiaries to whom the assets have been assigned. This mechanism is at the core of DGLegacy, specifically designed to fulfil the goal of inheritance of assets in the digital world.

The primary difference between existing secure vaults and DGLegacy is that the latter is created with the intention of being a digital inheritance vehicle for complex assets, instead of merely a secure vault.

With the DGLegacy application, you can protect your assets against unforeseen events and ensure that your family is secure. You can connect your preferred beneficiary with your preferred assets, and they will be notified at the time you choose – while ensuring they get the support they need in the process of claiming.

With DGLegacy, you can protect all types of assets. It is also easy to keep your list of assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets

![]() Can identify and locate your assets

Can identify and locate your assets

![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

Then are digital vaults dead?

On the other hand, the purpose of DGLegacy is to provide a secure digital inheritance tool for asset protection, ensuring that in the case of an unforeseen event, your family will be protected. They will be aware of your assets and know where to locate them and how to claim them.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the 10 000+ people who protect their assets with DGLegacy

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz