Crypto Inheritance

What are cryptocurrencies?

What are the different types of cryptocurrency?

Proof of Work

Cryptocurrencies that rely on the proof of work concept introduce a model in which all nodes (parts of the blockchain) compete to solve a complex cryptographic problem. The first one to solve it shares (or broadcasts) the solution to the other participants for verification. The most famous cryptocurrencies using this model happen to be the two largest ones by their market cap: Bitcoin; Ether (Ethereum)

Proof of Stake

This model differs from the proof of work model in a fundamental way: smaller pools of nodes compete to solve problems, as opposed to the whole network. That allows the proof of stake model to scale better and be faster than the first kind. Examples of cryptocurrencies that use this model are: Cardano, Eos , Dash

Tokens

Unlike the other two models, tokens don’t have their own blockchain system. Instead, they rely on (and are built on top of) an existing one, most commonly, nowadays, Ethereum. Their main advantage is the fact they usually represent physical value (they’re used in real estate, music and many other forms of art) and offer a diverse and easy way to buy and sell those physical assets (or parts of them) in a secure network. Some examples are: BAT, Tether

Stablecoins

Stablecoins were created in an effort to offer an alternative to the wildly fluctuating value of regular coins (such as Bitcoin and Ether). They are similar to tokens in the sense that they exist on a blockchain system that’s not their own, but at the same time, they allow trades for fiat (regular) currency; most importantly, they hold reserves of regular currency to back the value of the stablecoin. This hybrid model allows banks, for instance, to enter the crypto market. Examples of stablecoins are: Binance USD, USD coin

Why are cryptocurrencies important?

Cryptocurrencies are important for multiple reasons:

They are decentralized

There isn’t a central issuing authority, such as a central bank for normal currencies. This is crucial in terms of accessibility, ease of use, security, and application.

They’re owned by everyone

Cryptocurrencies use a peer-to-peer network. There are exchanges where you can perform transactions; however, you can generally just transfer whatever agreed currency you want to any other party; it’s fast and secure.

Transactions are fast, easy, secure, and global

Unlike regular money transfers, there is very little added complexity to making a transfer with a cryptocurrency. Transactions are much faster (due to the decentralized blockchain model cryptocurrencies use), more secure, and global.

Cryptocurrencies offer a high form of confidentiality

Transactions performed via cryptocurrencies are relatively confidential, compared with regular money transfers. This is a two-edged sword; then again, there are always pros and cons.

Technology

Last but not least, the existence of cryptocurrency relies on groundbreaking technology: blockchain. In a nutshell, the blockchain is a system for recording transactions – a digital ledger that is distributed and copied onto multiple systems – the entire network involved in the blockchain itself. This makes it very hard to cheat or hack the transactions performed within this system. This technology extends much further than merely cryptocurrencies and has found applications in multiple aspects of life.

Cryptocurrencies in terms of Legacy and Inheritance

Cryptocurrencies came about in 2008 (when the whitepaper introducing Bitcoin, the first cryptocurrency, was published), whereas the legal regulation of inheritance dates back thousands of years. So speaking about cryptocurrencies in terms of inheritance is a classic tale of old vs new, but with a twist.

There are fundamental differences between cryptocurrency and age-old assets that have been part of someone’s legacy and can be inherited. Nevertheless, cryptocurrencies are assets and consequently offer most, if not all, of the following benefits.

Can cryptocurrencies be inherited?

Cryptocurrencies are definitely a digital asset, and, as such, they can be inherited. If you’ve invested in crypto and would like to leave those assets to your loved ones, you absolutely can.

Can I include cryptocurrencies in my will?

You can, most definitely, include your crypto assets in your will. The loved ones you’ve designated as your beneficiaries will be able to inherit them like any other asset, all regular laws applicable.

Are there any risks with regards to crypto inheritance?

Via a digital legacy service, however, you’re able to store just enough information on your crypto investments to allow your loved ones to inherit them should something happens to you. DGLegacy neither stores nor authorizes any transactions with cryptocurrencies, thus adding a much-needed additional layer of protection.

DGLegacy® and Crypto Inheritance

What does DGLegacy® have to do with a Crypto Inheritance?

With DGLegacy®, you can protect your Crypto assets and loved ones in the event of unforeseen circumstances.

As a leading global digital inheritance service, DGLegacy® can help you navigate the complex landscape of crypto inheritance.

Simply catalog your digital, financial, non-financial and crypto assets and assign them to your preferred beneficiary, at the time you choose – while ensuring that your executor will know where to find your will.

With DGLegacy®, you can protect all types of assets. It is also easy to keep your list of assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets![]() Can identify and locate your assets

Can identify and locate your assets![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

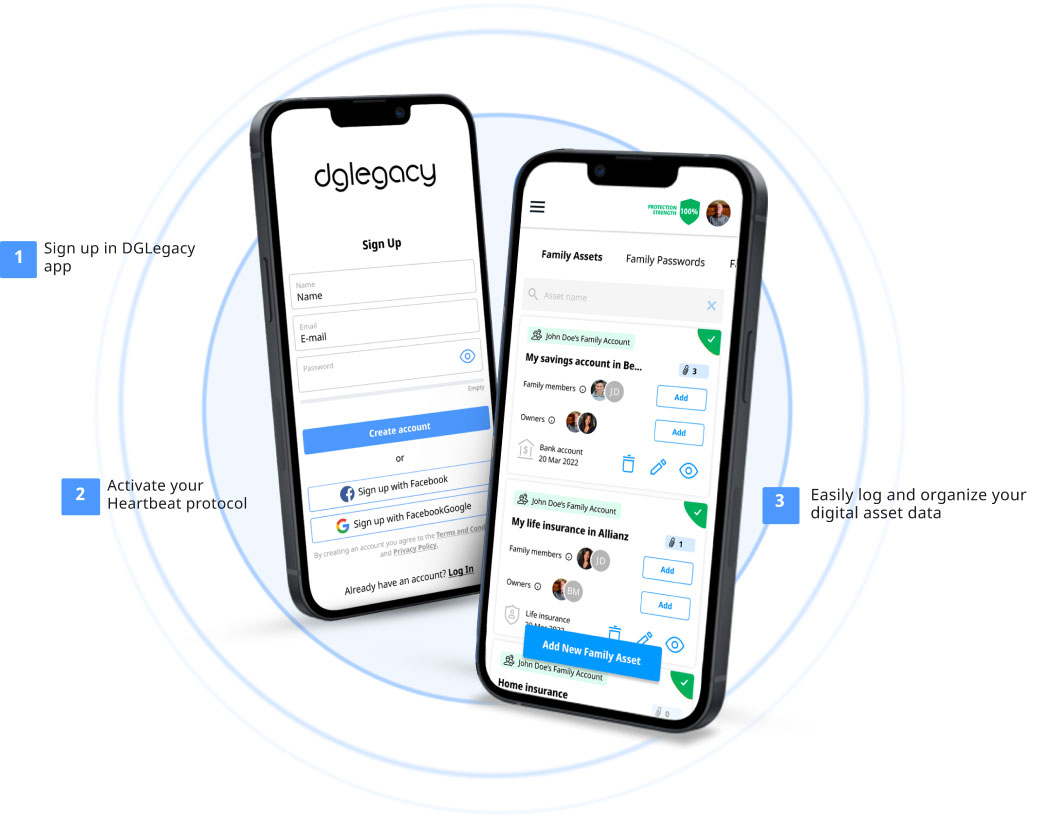

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the 10 000+ people who protect their assets with DGLegacy

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz