What is a Digital Will?

These days, more and more services around the globe have started offering digital wills to help people protect their assets and estates.

And this is not some fancy new hype. Traditional wills have plenty of inherent problems that digital wills try to solve, such as:

![]() Lack of transparency for your loved ones

Lack of transparency for your loved ones

If you create a traditional will now and store it in a drawer, will your loved ones know where it is after 30, 40 or more years? This risk alone invalidates the whole idea of wills, that they must ensure peace of mind and protection for your loved ones.

![]() People living in different cities or countries

People living in different cities or countries

It’s not easy to share the traditional will as it is on paper and you must share it physically with your beneficiaries – quite difficult when they live far away from you.

![]() Difficult to keep up to date

Difficult to keep up to date

Traditional wills take the approach that you spend considerable time and money once and will be protected throughout your lifetime. Think about what assets you possessed 10 years ago and compare them with the picture now. Quite a different asset catalog, right?

People these days have very dynamic asset catalogs

They open accounts in neo banks, create digital wallets, move to other countries and have local bank accounts and local insurances, invest in startup companies, receive stocks and options as part of their compensation packages, and open accounts in online trading platforms.

You can’t expect to go to your lawyer each time your asset catalog changes. Traditional wills are simply not fit for this modern reality.

When you add to this potential changes in your inheritance preferences and changes in your family situation, such as marriages or the birth of children, you can see that you need another solution to keeping your will up to date.

Digital wills try to solve all the disadvantages of traditional wills, but there is still plenty of confusion out there about them.

- Is a digital will the same as an online will or e-will?

- Do digital wills offer the same protection as traditional wills?

- What are the advantages and disadvantages of digital wills compared to traditional wills?

Let’s review these questions and several more in an effort to shed some light on the topic.

Digital Wills

Digital wills are provided by online services to enable people to easily create and maintain their wills.

Digital wills also have similar characteristics to traditional wills: the testators specify beneficiaries for their assets, inheritance preferences, witnesses, an executor of the will, the country and state, and, of course, the date.

The date is important as a person might update their will multiple times in their lifetime, so it’s very important to know which is the latest will.

On the surface, digital wills look similar to traditional wills, but they have many very important advantages. Some of these advantages are related to ease of use and convenience, but others significantly enhance the level of protection of your legacy. They are so important that they might be the difference between your loved ones inheriting your assets or not.

Advantages of the Digital Will

Easy creation

Creating a digital will is very easy. It usually takes 15 minutes or less, depending on the complexity of your estate.

You can do this from your computer at home; there’s no need to spend time going to law firms.

Easy update

A digital will enables you to easily update it based on your preferences, changes in family situation, changes in your asset catalog, or any other reason.

This is very important because this way you know that your digital will is always up to date and it ensures that your assets and loved ones are protected.

Your loved ones know where it is

Your loved ones know where it is When digital wills are combined with digital inheritance services, you also have a digital register of your assets and beneficiaries. Digital inheritance tools ensure that in the case of a fatal event, your loved ones will be proactively informed. They don’t need to remember the assets or their access details, and you don’t need to worry that your beneficiaries might not be able to find and access your will and assets.

Digital inheritance services ensure that your loved ones will be able to identify and locate your digital, financial, and physical assets.

Combined with a digital will, this is a very powerful tool to ensure peace of mind for you and your loved ones.

Cheaper than Traditional Wills

Digital wills are usually much cheaper than traditional wills. Lawyers charge differently, sometimes per hour, which is the most usual, and sometimes per will. But in both cases, creating a will with a lawyer is not a cheap option, especially if your estate is complex, e.g., assets in different countries, digital assets such as accounts in neo banks or online trading platforms, digital wallets, or special family situations. All these can make your traditional will pretty expensive.

Digital wills, on the other hand, are not only much cheaper than traditional wills, but usually their cost isn’t affected by the complexity of your estate – you pay the same price!

Are Digital Wills legally binding?

The answer to this question largely depends on your country and state. More and more countries in the world have approved digital wills as legally binding.

Many other countries are following suit. Of course, there are some caveats. For example, some countries allow for e-signature by the witnesses, while others require recorded video sessions.

Despite these differences, the path forward seems clear. In the very near future, most of the countries in the world will recognize digital wills as legally binding, in the same way as traditional wills are today.

Developed countries such as the USA and the UK are already taking the lead.

How to plan for it

The best way to plan for your digital will is to combine it with digital inheritance.

DGLegacy and Digital Will

What does DGLegacy have to do with a Digital Will?

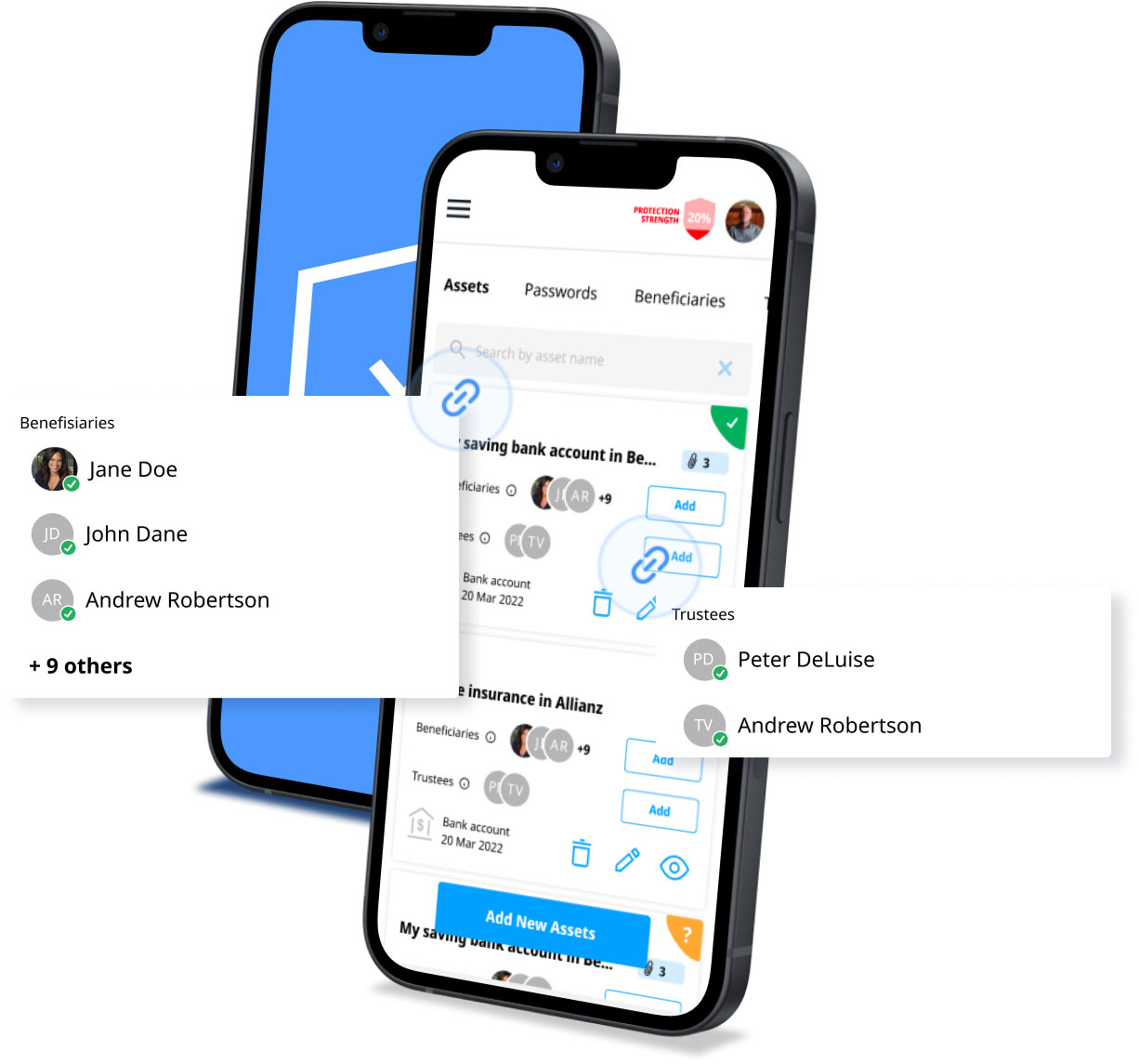

With DGLegacy, you can protect your personal assets and loved ones in the event of unforeseen circumstances.

You can catalog your digital, financial, and non-financial assets and assign them to your preferred beneficiary, at the time you choose – while ensuring that your executor will know where to find your will.

With DGLegacy, you can protect all types of assets. It is also easy to keep your list of assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets![]() Can identify and locate your assets

Can identify and locate your assets![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the people who trust DGLegacy® and start protecting your assets now.

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz