Secure Digital Vaults

In addition to these assets, many of which are digital, people have more and more documents that need to be stored, accessed, and organized – passports, health records, copies of policies, passwords, digital keys, etc.

Secure digital vaults were created to serve that specific need – to store and organize confidential information about assets and documents. In addition to storing, these vaults have the inherent capability of making the information accessible from anywhere, as they are online. You can get a copy of your passport during your business trip, details about your health insurance while you are on vacation, or information about your bank account keys.

To fulfil that need, digital vaults have a few very distinctive characteristics:

It’s not possible to compile a comprehensive list here, but these are the most important digital assets that you should consider:

![]() they have a very high level of security – this is required because of the sensitive and confidential data stored in them;

they have a very high level of security – this is required because of the sensitive and confidential data stored in them;

![]() they are online- the primary goal of the vaults is to be accessible from anywhere;

they are online- the primary goal of the vaults is to be accessible from anywhere;

![]() their access is strictly restricted to the owners.

their access is strictly restricted to the owners.

While they are accessible from anywhere, access to them is granted solely to the owners.

Digital vaults are very similar to banks: they store confidential information, they are very secure, and access to them is granted to the owners but is almost impossible to be granted to other people, including family members.

Types of vaults

While most secure digital vaults serve similar purposes, there are some slight differences between some of them.

Another evolutionary direction of digital vaults is as password managers. These vaults are designed to serve a niche need of storing passwords for various digital and non-digital applications such as email accounts, social profiles, and bank accounts.

These types of vaults often offer additional features such as automatic integration with external systems, which enables the owner of the vault account to automatically supply the password to external systems through the vault, instead of remembering or obtaining manually the individual passwords for each of the external systems.

Where secure vaults fall short

While secure digital vaults serve their purpose of storing confidential records and making them accessible to the vault account owner from anywhere, there is one area where these vaults fall short. It is the area of so-called digital inheritance. Put simply, this means making the vault account records accessible to family members or other beneficiaries should anything happen to the account owner.

The reason why vaults don’t serve that purpose well lies in their inherent design to restrict access to anyone but the account owner. That characteristic is at the heart of the very nature of vaults, and adding digital inheritance capability to such a system is not a trivial task.

That’s becoming a growing problem for vault account owners, as they want to not only securely store and access their digital records but also ensure that their family members will get access to them should anything happen to the vault account owner.

How does DGLegacy provide digital inheritance?

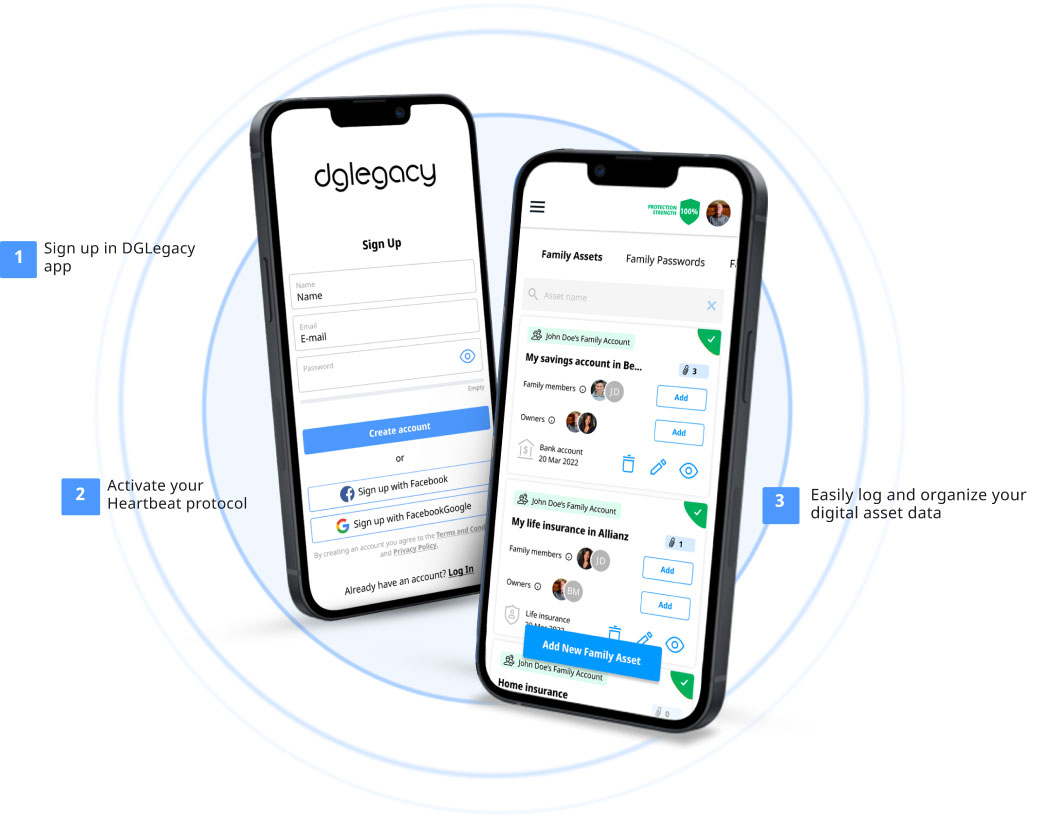

DGLegacy aims to fill that gap and fulfil the goal of digital inheritance in several ways, which are very distinctive from how secure vaults function.

First, DGLegacy enables people to designate beneficiaries for their assets. This is not an additional feature or perk at DGLegacy – it’s part of its core design.

Second, the application has a custom-engineered Heartbeat protocol which detects unforeseen events happening to the user. Upon detection of such an event, the information about the assets is provided to the beneficiaries to whom the assets have been assigned. This mechanism is at the core of DGLegacy, specifically designed to fulfil the goal of inheritance of assets in the digital world.

The primary difference between existing secure vaults and DGLegacy is that the latter is created with the intention of being a digital inheritance vehicle for complex assets, not merely a secure vault.

With the DGLegacy application, you can protect your assets against unforeseen events and ensure that your family is secure. You can connect your preferred beneficiary with your preferred assets, and they will be notified at the time you choose – while ensuring they get the support they need in the process of claiming.

With DGLegacy, you can protect all types of assets. It is also easy to keep your list of assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your assets

Are aware of your assets![]() Can identify and locate your assets

Can identify and locate your assets![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

Then are digital vaults dead?

On the other hand, the purpose of DGLegacy is to provide a secure digital inheritance tool for asset protection, ensuring that in the case of an unforeseen event, your family will be protected. They will be aware of your assets and know where to locate them and how to claim them.

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the 10 000+ people who protect their assets with DGLegacy

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz