Financial Literacy

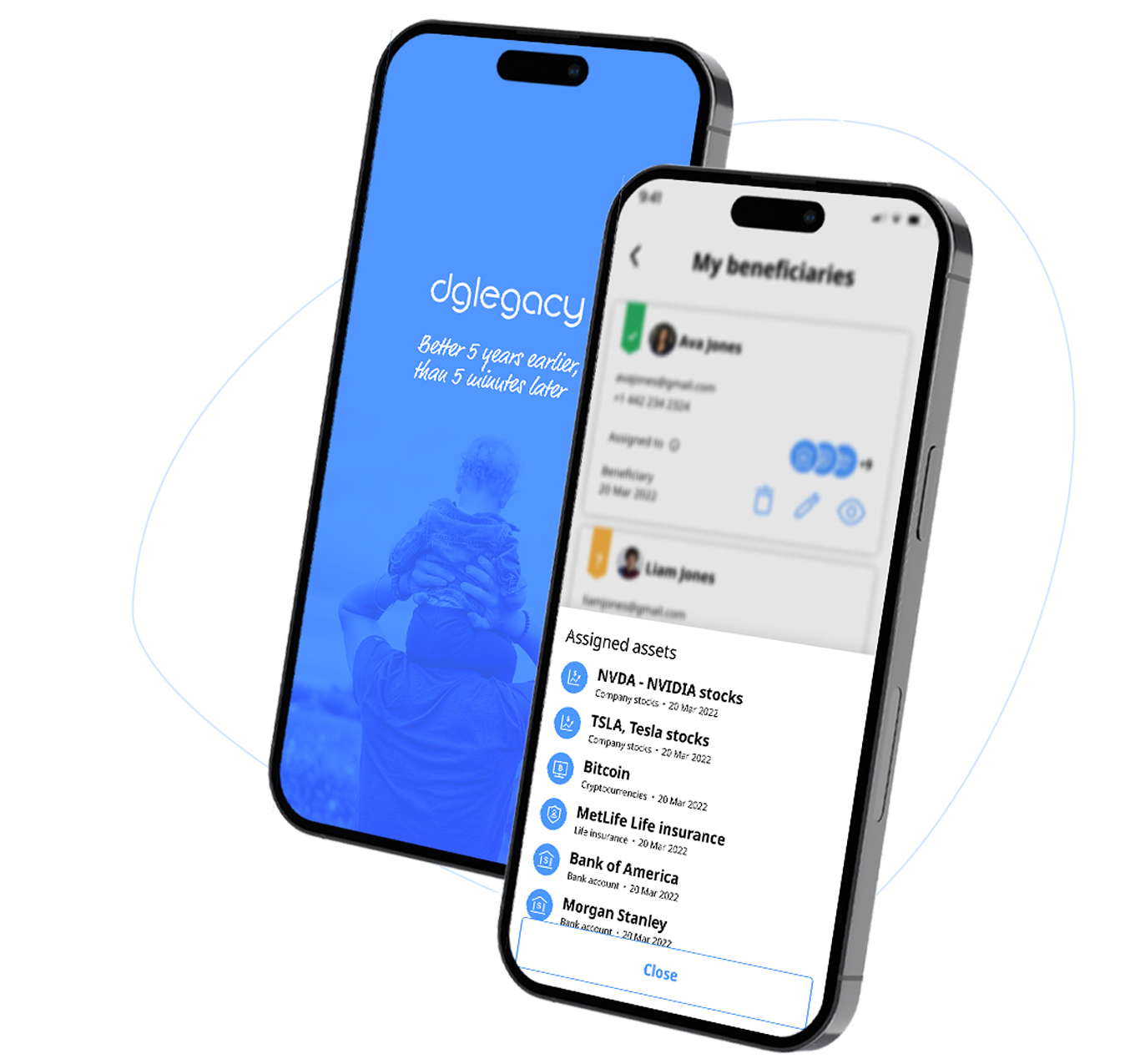

Master your digital legacy and financial literacy

Your go-to place for digital wills, secure vaults, crypto inheritance, and estate planning essentials.

Digital estate planning made simple

Plan, protect, and pass on your digital and financial assets with confidence.

DIGITAL ASSET ESTATE PLANNING

“From crypto to cloud files — will your digital assets survive you?” Many estate plans overlook digital assets, leaving families locked out of valuable accounts and investments. Discover how digital asset estate planning ensures your online wealth is protected and passed on without complications.

ESTATE PLANNING

“Most families face chaos without a plan. Will yours be prepared?”

Without proper estate planning, your loved ones could face legal hurdles, delays, and lost assets. Learn how to create a clear, secure plan that protects your wishes — and your family’s future.

LAST WILL AND TESTAMENT

“No will, no clarity. Will your family know your wishes?”

Without a valid will, your assets may be delayed, disputed, or lost. Learn how a clear last will and testament protects your loved ones and ensures your legacy is honored.

Protect your digital legacy

Your online presence and digital accounts deserve the same care as your physical estate.

DIGITAL LEGACY

“Your digital life doesn’t end when you do. Will your legacy live on?” From social media accounts to cloud files and crypto, your digital presence tells your story. Learn how to protect, preserve, and pass on your digital legacy to the people who matter most.

DIGITAL LEGACY MANAGEMENT

“Your digital life won’t manage itself. Will your loved ones know what to do?” From online accounts to crypto wallets, unmanaged digital assets can leave families locked out and overwhelmed. Discover how digital legacy management ensures your information is protected — and accessible when it matters most.

DIGITAL INHERITANCE

“Your digital assets don’t vanish when you do. Will your family know how to find them?” From online banking to crypto and cloud storage, digital inheritance is now a vital part of estate planning. Learn how to ensure your digital legacy is accessible, secure, and passed on without confusion or loss.

Secure Digital & Crypto Assets

Your digital and crypto assets can be lost forever without the right plan.

DIGITAL ASSETS

“From emails to crypto — your digital assets hold real value. Are they protected?”

Most people don’t realize how much of their wealth lives online. Learn what counts as a digital asset, why it matters, and how to safeguard it for the people you trust.

CRYPTO INHERITANCE

“Billions in crypto are lost forever. Will yours be?” Without proper inheritance planning, your digital assets could become inaccessible the moment you’re gone. Learn how to secure your wallets, safeguard your private keys, and ensure your crypto gets to the people you trust.

DIGITAL WALLET

“What happens to your digital wallet when you’re gone?”

From PayPal to crypto, your digital wallet holds real value — but without planning, your loved ones may never access it. Learn how to protect and pass on your digital funds with confidence and clarity.

Tools to Protect and Organize

Use smart tools to take control of your legacy and simplify your financial life.

DIGITAL WILL

“Wills aren’t just on paper anymore. Is yours ready for the digital age?”

A digital will helps protect your online accounts, assets, and passwords — and ensures your loved ones know exactly what to do. Learn how to create one that’s secure, accessible, and legally sound.

SECURE DIGITAL VAULTS

“Important documents get lost every day. Is yours protected — and accessible when it matters?” From wills to insurance policies, vital files often vanish just when they’re needed most. Discover how secure digital vaults safeguard your critical information — and ensure your family can access it when the time comes.

PASSWORD MANAGER

“One lost password can lock out your legacy. Are your accounts really secure?”

With countless logins and growing digital footprints, a single forgotten password can mean lost assets or access. Learn how a password manager protects your digital life — and makes sure your loved ones aren’t left guessing.

Strengthen Your Financial Foundation

Build resilience and security across your entire financial portfolio.

LIFE INSURANCE PROTECTION

“Life insurance isn’t enough if no one knows it exists. Will your policy truly protect your family?” Millions in life insurance go unclaimed each year because beneficiaries are unaware. Learn how to make your policy known, accessible, and ready to support your loved ones when it matters most.

ASSET PROTECTION

“Your wealth is exposed to more risk than you think. Are your assets truly safe?” From digital theft to legal disputes, today’s assets face threats your traditional plan may miss. Discover how modern asset protection strategies help you secure what you’ve worked hard to build.

ASSET MANAGEMENT

“Billions in assets go untracked every year. Is your portfolio protected?”

Millions of people unknowingly lose control of their assets — from forgotten accounts to unlisted insurance policies. Learn how smart asset management can help you organize, protect, and pass on what’s rightfully yours.

PERSONAL FINANCE

“Most people don’t know where their money really goes. Are you in control of yours?”

From forgotten subscriptions to untracked investments, poor financial visibility can quietly drain your wealth. Learn how to take charge of your personal finances and build a future with clarity and confidence.

Why it matters

Don’t let your assets get lost

1 in 7 U.S. residents have unclaimed assets, such as bank accounts, insurance policies, or digital accounts.

No financial or legacy plan

- Only 33% of adults in the U.S. have a will or estate plan

- Over 50% have no documentation covering their digital assets

- 49% bank online; 32% rely solely on mobile — yet most plans don’t account for access

With DGLegacy®

- Comprehensive coverage of digital and financial assets

- Automatic notifications to selected beneficiaries

- Encrypted vaults for documents, passwords, crypto & insurance

Take Control of Your Digital Legacy!

Protect your loved ones when it matters the most

Register now and start setting up your digital legacy. Be sure that your digital and financial assets are protected.

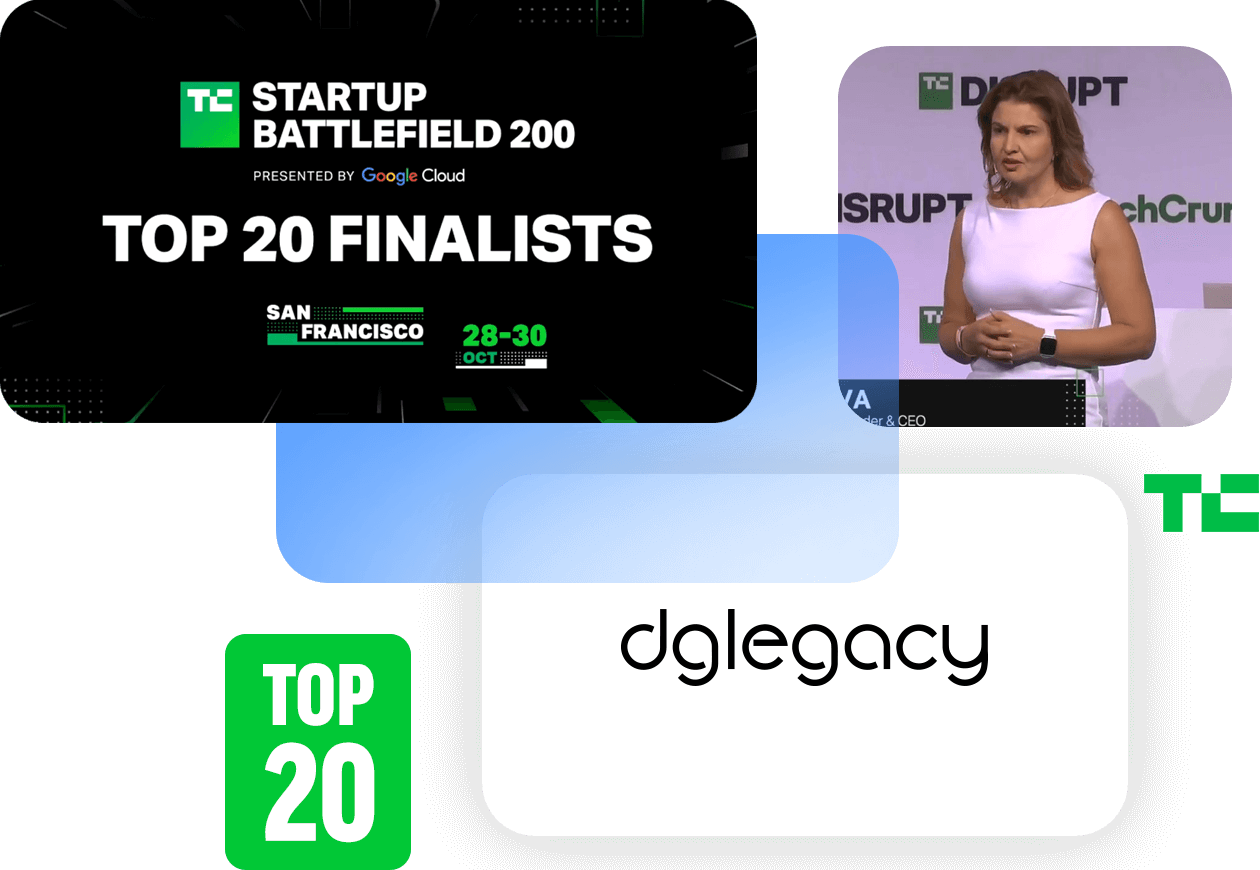

Globally Recognized Excellence

TechCrunch Top 20 Global Startups

DGLegacy® has been recognized as one of the Top 20 Most Innovative Startups Globally at TechCrunch Disrupt 2024, the world’s premier stage for groundbreaking technology and innovation.

This prestigious recognition reflects our dedication to innovation, security, and helping people worldwide with forward-thinking digital legacy planning and inheritance solutions.

Learn more

Frequently asked questions

What is financial literacy and why does it matter for estate planning?

Financial literacy is the understanding of how money, assets, and planning tools work — including budgeting, saving, investing, and inheritance. Without it, people often miss key steps in securing their legacy, protecting their digital assets, and providing for their loved ones.

What happens to my digital accounts when I die?

Without clear instructions or access, digital assets like email, cloud storage, social media, and crypto accounts can become inaccessible or permanently lost. A digital estate plan ensures your beneficiaries know what exists, where to find it, and how to access it.

Do I need a will if I already have a digital vault?

Yes. A digital vault helps you organize and securely store documents, passwords, and information, but it doesn’t replace legal tools like wills or trusts. Both work best together — the will directs what happens legally, the vault makes sure it’s accessible.

Can I include my crypto and NFTs in my estate plan?

Absolutely. Digital assets like cryptocurrency and NFTs should be explicitly included in your estate plan. You’ll also need to store access keys or wallet instructions in a secure way — DGLegacy’s encrypted vault is designed for this purpose.

I’m young and healthy. Isn’t it too early to think about inheritance?

Not at all. Financial literacy and legacy planning aren’t just for later in life — they help you protect your assets, prepare for the unexpected, and avoid complications for loved ones at any age.

How does DGLegacy® help improve my financial literacy?

DGLegacy® offers curated content, and easy-to-follow guides that empower you to understand and take action on estate planning, digital inheritance, insurance, and asset protection — all in one secure place.