Digital Assets

None of us can deny the fact that the Internet revolution of the 1990s has changed the lives and habits of contemporary man. The World Wide Web and the Internet laid the foundations of modern commerce, provided new forms of communication, and facilitated the search for information and the collection of data.

Before the age of the Internet, people owned only physical assets: real estate, money made of metal or paper, paintings and other valuables, books and other intellectual property.

In the digital age, our possessions are no longer only physical but also digital. So, how do we define a digital asset?

What is a digital asset?

It is difficult to determine the correct definition of a digital asset. The digitalization of society is developing at such a rapid pace that new and different categories of assets are being added almost every day.

It is important to say that a digital asset does not differ from a physical asset in terms of its potential to provide a current or future economic value to an individual or an enterprise company. In this sense, digital assets are the digital representation of traditional assets that generally do not have the legal status of currency or money (although in some cases they do) and are not issued or guaranteed by a central bank or public authority.

Most of them are accepted by individuals and legal entities as a payment method, can be transferred, stored, and traded electronically, and can be used for investment purposes, but they are not legal tender and are not guaranteed by the central banks.

Recently, some of the cryptocurrencies, e.g., Bitcoin, were officially adopted as legal tender in some countries, whereas in other countries, cryptocurrencies are illegal and banned either completely or implicitly.

Digital asset types

Although there is still no official classification of digital asset types, we can easily identify 3 distinct groups: Digital financial assets, Digital intellectual property, and Digital creative assets.

Digital financial assets

Payment tokens

A payment token is the purest form of cryptocurrency; it is a medium of exchange of digital money through blockchain technology. Cryptocurrencies are not tangible, but this does not prevent people from using them for purchasing goods and services or as an investment tool.

Utility tokens

Utility tokens are the digital version of the well-known vouchers that we use to purchase products or services. Utility tokens provide one-time access to a specific product or service.

Security tokens

Security tokens are the digital representation of conventional securities such as company shares, bonds, or certificates, digitized through blockchain technology and embodied in crypto tokens.

Digital intellectual property

Digital intellectual property that you have protected is also considered as a digital asset. Some types of digital intellectual property might have great monetary value. Good examples of digital assets with great monetary value are:

- Registered trademarks

- Software programs

- Patents and trade secrets

- Copyrighted digital books, music,etc.

Digital creative assets

Digital creative assets are usually linked to companies and their marketing, but that does not mean that individuals do not possess creative assets as well. Digital creative assets are simply the digital analog of traditional creative assets. Typical examples of such assets are:

- Photos

- Images

- Graphics

- Audio files

- Video files

- Presentations

- Spreadsheets

It’s important to note that these days many of the traditional physical assets also have digital access

A few examples:

Bank accounts

accessed through neobanks or the web portals of traditional banks

Company stocks

bought, sold and managed through online trading platforms or mobile trading applications

Stock options, RSUs or ESOPs

stored and managed through online platforms such as Carta and E*TRADE

Insurance policies, such as life insurance

bought and managed through digital insurance brokers or web portals

Digital asset management

Digital asset management has several different contexts, depending on whether it is meant to serve an enterprise company or an individual.

Digital asset management systems for businesses

B2B enterprise digital asset management systems allow users to store, search, find, and use digital content, e.g., artwork, logos, blog posts, and corporate photos. These are digital files in which the enterprise has invested resources to create and represent a current, future, or potential economic value to the entity.

Digital asset management services for individuals

On the other hand, digital asset management services for individuals aim to help them not only to store, find and use their digital assets but also track and manage them easily, which is vital in everyone’s daily life.

Are digital assets property?

According to Wikipedia’s definition, “Property is a system of rights that gives people legal control of valuable things, and also refers to the valuable things themselves.”

Digital asset protection

While it is perfectly understandable why society is obsessed with the problem of cyber security, there is no reliable explanation for why people rarely protect their assets from the hazard of being lost.

And while the adoption of digital assets has redefined the world of finance, giving people new investment instruments and facilitating cross-border payments, the adoption of digital asset protection against the risk of these assets being lost is still in its infancy.

Digital inheritance services as a means of asset protection: why is it so critical to use them?

Why using a digital inheritance service is so critical for you and your loved ones

Now the use of a digital asset inheritance service seems more and more important.

Understanding what digital assets exist and navigating the rights for heirs to access and use those digital assets after a person has died is extremely difficult if no digital inheritance has been put in place.

Due to a lack of legislation regulating the inheritance of digital assets, there is a limited ability to identify and locate these assets in the event of the owner passing away. There is a high probability that these assets will be lost forever, not only to the owners’ loved ones but also to society in general.

DGLegacy helps to protect your digital assets

How does DGLegacy help you to protect your digital legacy?

With DGLegacy, you can easily catalog your digital assets, which enables you to protect not only them but also your loved ones should an unforeseen event happen to you.

You are able to catalog your digital, financial, and non-financial assets, designate your preferred beneficiary to them, and have them notified at the time you choose – while ensuring that your executor will know where to find your important inheritance documents.

With DGLegacy, you can protect your digital legacy. Your secure document and password manager with digital inheritance also makes it easy for you to keep your list of digital assets and beneficiaries up to date.

This way, in the event of anything unforeseen happening to you, your loved ones:

![]() Are aware of your digital legacy

Are aware of your digital legacy![]() Can identify and locate all your assets

Can identify and locate all your assets![]() Can minimize the chance of unclaimed assets.

Can minimize the chance of unclaimed assets.

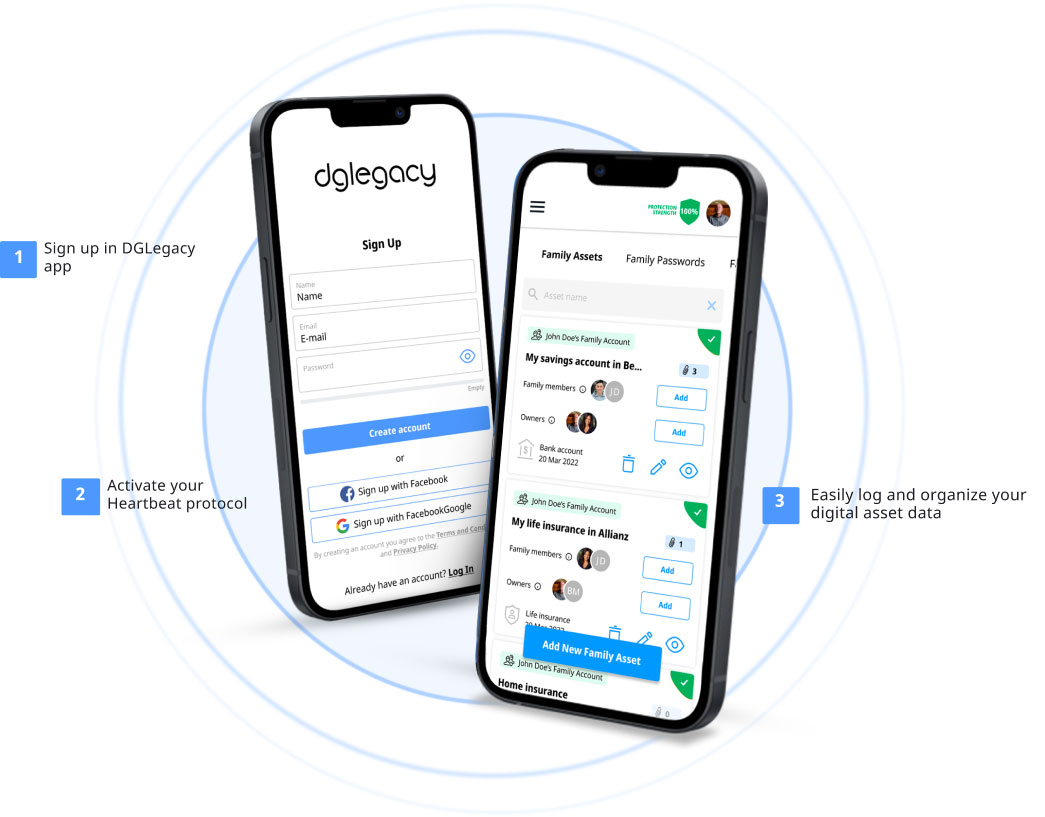

HOW IT WORKS

Protect your loved ones quickly and easily

Set up “alive” event

Crucial for the system's functioning, this step allows us to monitor that you are “alive”, we name it HeartBeat protocol. You have the option to adjust according to your preferences.

![]()

Catalog your assets

Catalogue the assets via DGLegacy, with minimum basic information needed, allowing your beneficiaries to identify and locate them.

![]()

Protect your assets

In case of a cyber security breach in a company which holds your assets, or media alerts for a risk related to its financial stability, DGLegacy will proactively notify you.

![]()

Invite beneficiaries and trustees

To add beneficiaries and trusties you need only their basic contact information - email and name. They will receive an invitational email.

![]()

Detection of fatal event

The Heartbeat protocol of DGLegacy, custom-engineered for your safety, confirms your well-being and detects any unexpected events. We proactively notify your beneficiaries about their designated assets in case of a tragic event.

TESTIMONIALS

Why DGLegacy® is the #1 place to secure your assets

![]()

![]()

CATALOGUE YOUR FIRST ASSET

Protect your loved ones when it matters the most

Join the 10 000+ people who protect their assets with DGLegacy

Victor

Victor Vlad

Vlad Ingrid Henke

Ingrid Henke Alara Vural

Alara Vural Agnieszka Michalik

Agnieszka Michalik Stella Schmitz

Stella Schmitz